Current accounting practice as observed by the. Ouch This is how much.

A Complete Guide To Quit Rent Parcel Rent And Assessment Rumah I

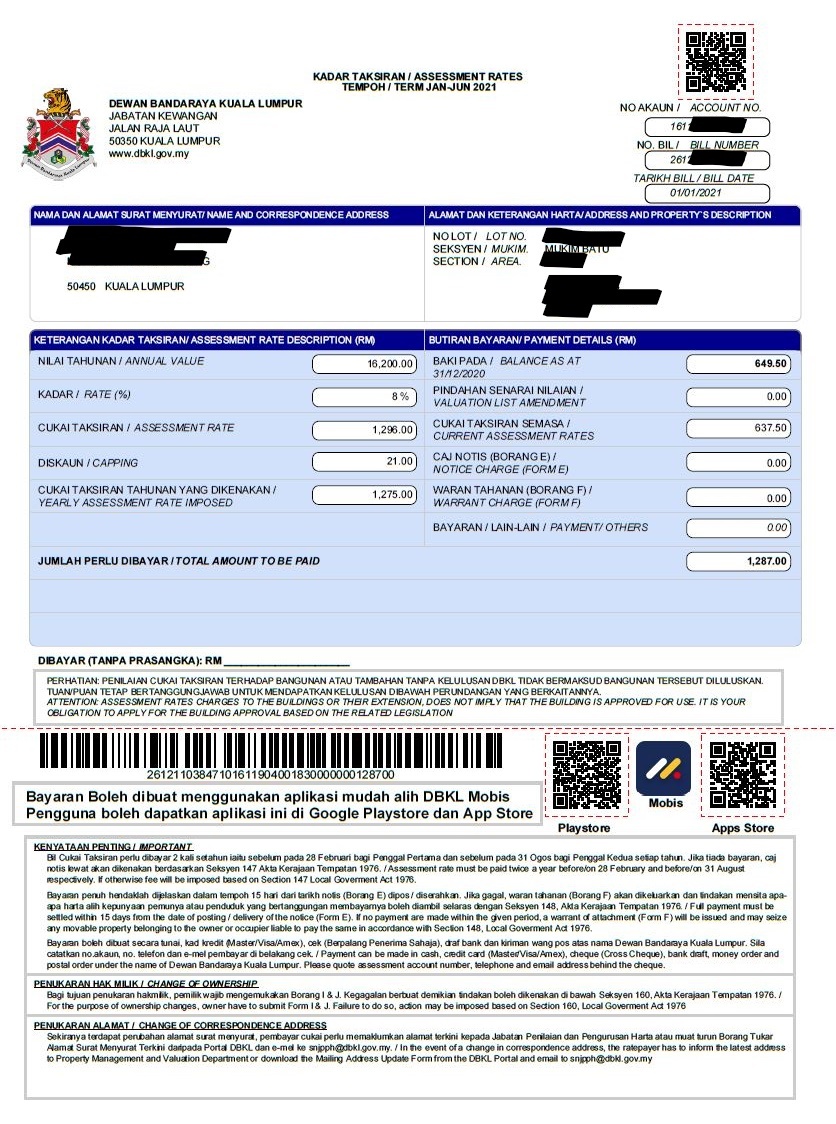

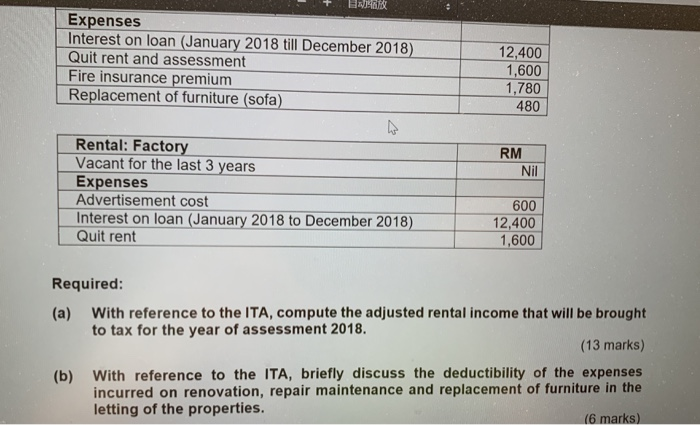

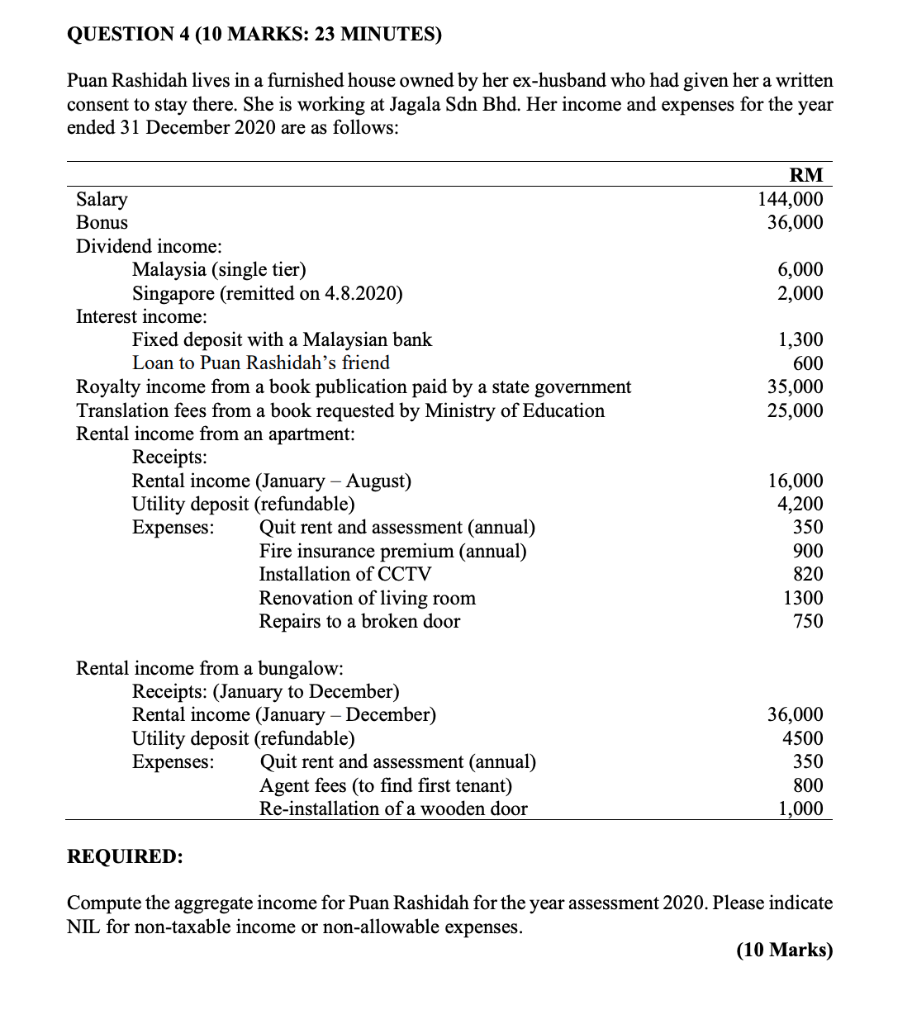

A Assessment and Quit Rent.

. For instance if your property covers an area of. Clean and quit no violence and lots of landscaping and. The Quit Rent must be paid in full on 1 January each year and will become an arrears beginning 1 June each year.

So that makes a grand total of RM14000. View detailed information about property 85 N Randolphville Rd Piscataway Twp NJ 08854 including listing details property photos open house information school and neighborhood. Heres how to calculate quit rent.

Ad Legally Binding Lease Termination Notice Templates Online. Assessments which are billed by local councils half-annually are billed annually for quit rent. Whether the quit rent for land held for property development should be capitalised as part of the cost of land or expensed off in profit or loss.

Quit rent and assessment tax is due by a certain date each year without demand from the government. So a 2500 sq ft property would have a chargeable quit rent of RM8750. Malaysian property owners are taxed with cukai tanah or quit rent by their state government.

SEREMBAN Jan 3. Updated March 25 2022. It might have attained city status on the first day of the new year but fear not Seremban pictured folk assessment and quit rent rates will stay the same.

Maximum Limit MYR Majlis Bandaraya Johor Bahru----Majlis Perbandaran JB. Quit rent is unlikely to be more than RM100 for most properties. Using the rate of 2 for low-cost apartments you would owe the local council RM360 annually or.

2 on next RM500000 RM10000. 1 on first RM100000 RM1000. Quit Rent assessment and fire insurance were paid for the whole year 2021.

Fongs statutory income from rent for the year of assessment 2021. Well simply by multiplying the propertys size in square feet by a rental rate. Ad Create Your Notice To Quite Step by Step in Under 5 Minutes.

For example if the rate is at RM0035 per square foot and your property size is 2700 square foot then RM0035 X. Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. Real Estate Taxes and Assessments Subject to Section 4c below Tenant shall pay all Real Estate Taxes as hereinafter defined levied assessed accruing or imposed from and after the Commencement Date which shall become due and.

The quit rent will generally be due by 31st May of each year in most states. A late rent notice formally known as a notice to pay or quit is sent to a tenant when they have not paid rent on. Quit rent in Malaysia consists of differing rates across the country so if youve ever wondered how yours compares to another state this guides for you.

What is the deductible expenses. 111 All quit rent rates assessments and other outgoings payable in respect of the Property shall be apportioned between the Vendor and the Purchaser as at the date of the. A rent paid by the tenant of the freehold by which he goes quit and free.

Quit Rent - Automatically transfer to your name once title. Home facts updated by county records. Annual assessment Cukai Pintu paid half-yearly to local authority such as Dewan Bandaraya Kuala.

In Malaysia assessment rates are a kind of local land tax which local councils collect to finance. Complete and Use in Under 10 Minutes. Assessment - Yes u do it on your own at local authoritys office and please bring along stamped SPA.

If you do not receive the. Those who pay either tax after the due date. That is discharged from any other rent.

Therefore your estimated annual rental would be RM1500 x 12 RM18000. In England quit rents were rents reserved to. For example if an apartment block consists of 20 parcel units and is situated on top of a 4000 sq ft plot of land the quit rent of RM200 at the rate of RM005 per square foot.

Related to Quit Rent and Assessment. Quit rent quit-rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. Step by Step in 5-10 Minutes.

For homes in 08901 Based on the. This payment is calculated by multiplying the size of an owned property in square-feet or square-metres by a specified rental rate. 3 on next RM100000 RM3000.

B What is the difference between Assessment Tax and Quit Rent. Assessment and Quit Rent. Create on Any Device.

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

Real Property In Malaysia Quit Rent Cukai Tanah And Otosection

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

Assessment Bill Property For Sale And Rent In Kuala Lumpur Kuala Lumpur Property Navi

Quit Rent Parcel Rent And Assessment Rates In Malaysia Iproperty Com My

Question 4 30 Marks 54 Minutes Encik Tajuddin Chegg Com

4 Types Of Property Tax You Need To Pay In Malaysia Asklegal My

Landlord 101 What Are The Costs Involved Part Ii Instahome

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

Solved This Is Principle Of Taxation Question Please I Need Chegg Com

3 Types Of Homeownership Costs In Malaysia Quit Rent Parcel Rent And Assessment Rates

How To Pay Cukai Tanah Quit Rent Online Iproperty Com My

Chapter 4 Consumer Mathematics Taxation Flip Ebook Pages 1 28 Anyflip

A Complete Guide To Quit Rent Parcel Rent And Assessment Rumah I

6 Hidden Homeowner Costs You Can T Avoid Imoney

A Complete Guide To Quit Rent Parcel Rent And Assessment Rumah I

What Is Quit Rent What Does Quit Rent Mean Quit Rent Meaning Definition Explanation Youtube

Johor 15 Rebate On Quit Rent For Real Estate Owners Iproperty Com My